|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

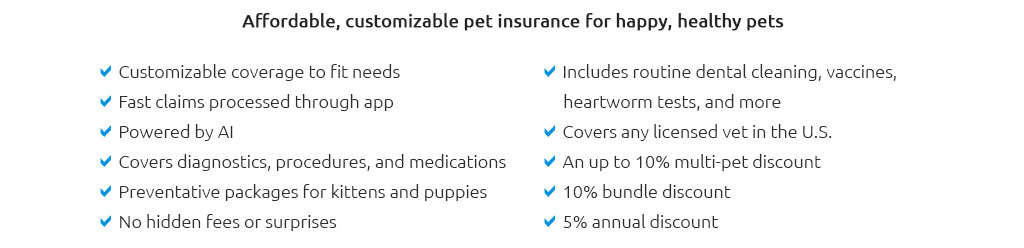

Pet Health Insurance Comparison: Navigating Available OptionsIn today's world, where our pets have become integral members of our families, ensuring their health and well-being is paramount. Pet health insurance has emerged as a viable solution for managing unexpected veterinary expenses. However, with a myriad of options available, choosing the right plan can be daunting. This article aims to provide a detailed comparison of popular pet health insurance options, helping you make an informed decision. Firstly, let's consider coverage options. Most pet insurance plans offer a range of coverage from accident-only to comprehensive plans that include illness, hereditary conditions, and even wellness care. For example, Company A offers a basic accident-only plan, which might be suitable for younger pets with fewer health issues, whereas Company B provides an all-encompassing plan that includes dental and alternative therapies. It’s crucial to assess your pet's specific needs and potential health risks when selecting a plan. Another important factor is the cost and flexibility of premiums. Plans can vary significantly in price, often influenced by factors such as the pet’s age, breed, and your geographical location. Company C might offer lower monthly premiums but could have higher deductibles and co-pays, while Company D provides more flexibility with customizable plans that allow you to adjust deductibles and reimbursement levels according to your budget. When comparing plans, it's also vital to understand the exclusions and limitations. Many plans do not cover pre-existing conditions, and some have breed-specific exclusions. For instance, if your pet is a breed prone to hip dysplasia, you must ensure this condition is not excluded from the plan you choose. Company E is known for its transparent policies with fewer exclusions, making it a preferred choice for many pet owners.

In conclusion, selecting the right pet health insurance involves a balance of coverage, cost, and service. It's advisable to thoroughly research and compare several plans, keeping in mind your pet's health history and your financial situation. Ultimately, the peace of mind that comes with knowing your pet is protected is invaluable. By carefully evaluating your options, you can ensure that you choose a plan that provides comprehensive protection for your furry friend at a reasonable cost. https://www.dvm360.com/view/pet-insurance-comparison-chart

What should veterinary professionals and pet owners care about in considering pet insurance plans? Here's the latest information from some of ... https://www.embracepetinsurance.com/compare

Before choosing a policy, confirm that it includes all the potential treatments your pet might need, including , dental health and optional coverage for routine ... https://www.aspcapetinsurance.com/research-and-compare/compare-plans/

Compare plans from a number of companies, and read customer reviews. All of this can help you make an informed and confident decision about covering your pet.

|